What Does the Financial Planning Process Actually Look Like?

If you've never worked with a financial planner before, you might wonder: “What will we do together, exactly?” Great question. Financial planning isn’t just about spreadsheets or stock market updates. It’s about helping you clarify what matters most, understand your options, and feel more confident navigating your financial life.

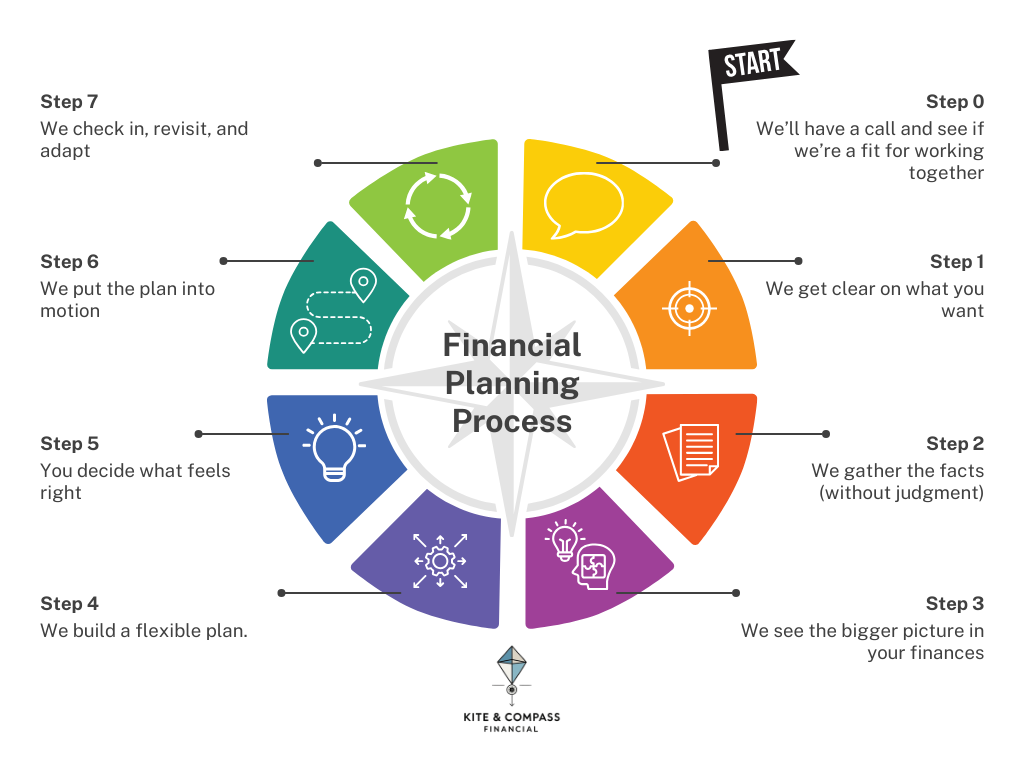

Here’s how we’ll typically work together (graphic at the bottom if you like visuals):

1. Map Your Reality: We get clear on what you want.

We'll talk about what's going on in your life, what's working and what's not, and what you'd like more of. Whether it's retiring early, affording gender-affirming care, buying a home with chosen family, or just feeling less stressed about money, your ideal life and goals are the compass.

2. We gather the facts (without judgment).

That might include income, benefits, savings, debt, pensions, insurance, spending, and anything else that touches your money. I'll guide you through this part and help organize what you already have, so it doesn't feel overwhelming.

For CalPERS and CalSTRS members, this includes understanding your pension benefits, service credit, and how they fit into your complete financial picture, especially if you're considering leaving public service or have an unconventional career path ahead.

3. We see the bigger picture in your finances.

Together, we'll look at how all the pieces fit and what gaps or opportunities might exist. This isn't about "shoulds"; it's about understanding your financial landscape so we can make it work for you.

4. Design Your Path: We build a flexible plan.

This is where we connect the dots: what you want, what you have, and what steps will move you forward. You'll get clear, personalized recommendations grounded in your values, not just what some generic online calculator says.

5. You decide what feels right.

I'll walk you through your options and the trade-offs of each choice, then you decide what feels doable for your actual life. There's no pressure to follow a rigid timeline, and we'll adjust as your circumstances or priorities change.

6. We put the plan into motion.

For ongoing clients, I stay in the loop to help with implementation. This could mean: additional meetings to dive deeper into topics like college planning or legacy planning before you see an estate attorney; coordinating with your tax preparer; reviewing job offers or career transitions; or simply troubleshooting as you go.

Either way, you won't be left hanging with a plan you don't know how to execute.

7. Live With Confidence: We check in, revisit, and adapt.

Life changes and your plan should too. For ongoing planning clients, we'll touch base regularly and revisit the plan together when something shifts: a new job, a new relationship, a move, or simply a change of priorities. The plan adjusts to stay in sync with you.

Closing Thoughts

Financial planning isn't just a document you receive at the end of our engagement - it's a collaborative, values-driven process that grows with you as your life changes.

Ready to get started? Whether you need focused help on one decision (Clarity Session) or a complete financial roadmap (Ongoing Planning), let's talk about what makes sense for you.

Not quite ready? Browse more financial planning insights or learn more about my “why.”

Disclaimer: This information is for educational purposes only and doesn't constitute financial advice. Consider consulting with a fee-only financial planner for personalized guidance.